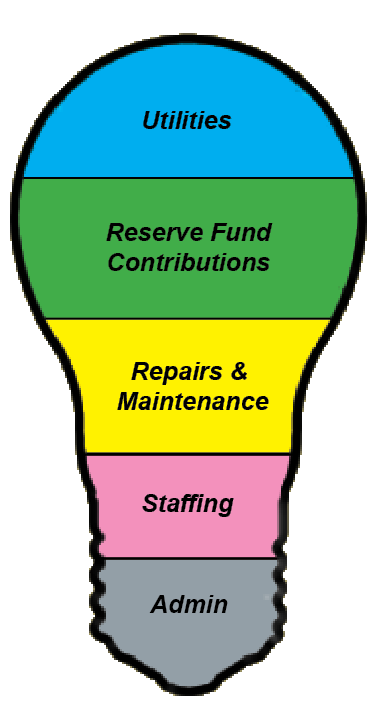

Condo Finance Management

Every condominium is different. A large highrise and a small townhouse are going to have vastly different needs, but there are still some similarities that exist. BPM takes a close look at all of your expenses, and carefully finds ways to keep costs down while maintaining service levels.

Utilities

Utilities can be the single largest expense in condominiums where there is no sub-metering. BPM works to bring these costs down by overseeing energy audits of the building, and ensuring the recommendations from these audits are put into practice.

Reserve Fund Contribution

Every three years the property is required to do a Reserve Fund Study, which tells the owners how much they need to save for major projects. BPM works with the engineers doing these studies to ensure that cash flow is managed in an intelligent way, to keep fees from going up.

Repair and Maintenance

At BPM, our Condo Finance Management style focuses on spending our time (and your money) preventing problems, rather than reacting to them. We work with any and all vendors, and do not require any condominiums to use "our" workers. That being said, if your condominium needs a recommendation for repairs and maintenance, we are happy to help!

Staffing

Good staff members are a vital part of any condominium. BPM works closely with staff members to ensure they have the tools they need to succeed.

Administration

We see it every time we take over the condo finance management of a condominium. Dozens of forms and documents, all meant to track exactly what is going on - and all of them blank! BPM works to streamline your administration so that the staff members can keep up and spend their time on the important things that add value to the condominium.